Materiality

Materiality assessments are vital for our value creation journey as we seek to identify the ESG issues that matter most to our business and stakeholders.

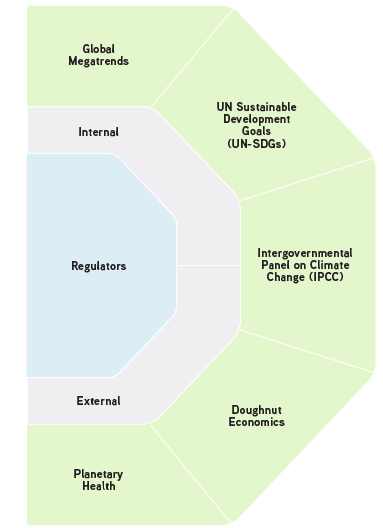

In 2022, a thorough materiality assessment was conducted, garnering over 1,100 responses through an extensive online survey from stakeholders. In 2023, a materiality validation was undertaken to align these issues with relevant regulatory requirements and frameworks, including those of Bursa Malaysia, common and sector-specific sustainability matters.

A

IDENTIFICATION OF MATERIAL ISSUES

Meeting national regulatory requirements is a priority in our reporting practices. Since 2015, Bursa Malaysia has made it mandatory

for all public listed companies to publish a sustainability statement under the Main Market Listing Requirements (MMLR) and the Ace Market Listing Requirements. Since then, we have been reporting our sustainability performance in a standalone Sustainability Report on an annual basis to comply with Bursa Malaysia’s mandatory disclosures. In September 2022, Bursa Malaysia enhanced the MMLR sustainability reporting requirements and listed 11 common sustainability matters and several sector-specific sustainability matters. Sunway Berhad has since disclosed against all the required sustainability matters.

Identifying the internal and external risks to our business is equally important to ensure sustainable business growth. To truly drive

sustainability across our organisation, we have identified and incorporated ESG risks into the Group’s internal risk focus areas. These areas encompass external, people, financial, digital infrastructure, climate, environmental and social.

In addition, we referred to several global sustainability indices and rating and ranking tools to better understand our exposure to

sector-specific risks that are relevant to our industry classification. Among the indices used were FTSE Russell, Sustainalytics and

S&P Global.

For a comprehensive analysis, we took into consideration global megatrends or issues that could directly or indirectly affect our business. We then aligned our responses with the 17 UN-SDGs and applied the Doughnut Economics Model Framework that seeks

to provide a safe and just space for humanity without breaking the ecological ceiling, thus balancing human needs with planetary boundaries. Further to that, we considered global megatrends by the annual World Economic Forum (WEF) Global Risk Report and the Intergovernmental Panel on Climate Change (IPCC) Report.

We gathered feedback from our stakeholders through an online survey to identify the material issues that should be prioritised according to our resources.

B

The materiality assessment conducted in 2022 resulted with 14 material issues which addressed economic, environmental, social and governance issues that better reflect our management approach.

ECONOMIC

- Macroeconomic issues

- Company’s financial

performance - Responsible and

sustainable financing - Capital allocation strategy

- Brand and reputation

ENVIRONMENTAL

- Climate action

- Protection of biodiversity

and ecology - Pollution management

SOCIAL

- Value chain improvement

- Employee well-being

- Human rights

- Community investment

GOVERNANCE

- Group standards and operating procedures

- Innovation and

technology

C

STAKEHOLDER ENGAGEMENT

We engaged with our stakeholder groups via an online survey to identify and gauge the material issues that should be prioritised based on the resources available to us. We received more than 1,100 responses from the survey conducted.

Internal

Board of Directors

Employees

Sunway Senior Management / Business Division Heads

External

Customers

Media & NGOs

Suppliers /Vendors

Investors / Financiers / Analysts

Government Agencies / Regulators / Local Authorities

D

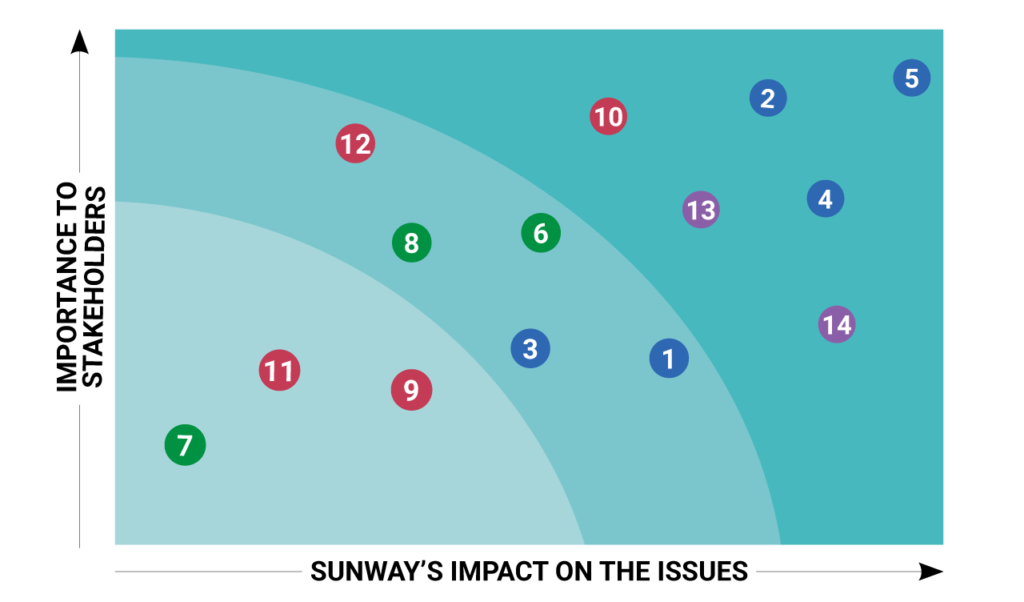

In 2022, we conducted a comprehensive materiality assessment with 14 material issues addressing economic, environmental, social and governance issues to better reflect our management approach. The results of the materiality assessment revealed six material issues that were most significant to stakeholders based on their impact on Sunway and Sunway’s impact on the issues. As part of our commitment towards Net Zero by 2050, we included Climate Action as the seventh prioritised material issue. These seven material issues reflect how we are shifting away from a solely profit-driven business strategy toward a multi-capital, multi-value perspective.

PRIORITISED MATERIAL ISSUES

- Brand and reputation

- Capital allocation strategy

- Company’s financial performance

- Climate action

- Employee well-being

- Innovation and technology

- Group standards and operating procedures

In 2023, an external consultant was engaged to conduct a desktop validation review and ensure that our material issues were aligned with the relevant regulatory requirements and frameworks. These were in addition to global ESG frameworks, megatrends, and risks, as well as industry peers. While the review did not show that Brand and Reputation and Capital Allocation Strategy were among the most common material matters adopted by industry peers, we prioritized the two issues due to their relevance to our business. Both the material matters also reflect our transition from a solely profit-driven business towards a multi-capital and multi-value path. This is supported by our recognition that ESG can, and has already, improved our financial performance.

E

The findings from the materiality validation were presented, approved and endorsed by the Board Sustainability Committee.